The purchase order processing module in Dynamics GP allows me to create purchase orders, receive against those purchase orders, and then invoice those receipts. - Let's take a look at how it works to create a new purchase order. I'll navigate like this: I'll go to Transactions, Purchasing, Purchase Order Entry. This brings up the screen where I can enter my purchase order. - I'm going to tab through the fields, starting with the number. Over the vendor ID, I can either look up the vendor or key it in. In this case, I'll look it up and select Advanced Office Systems. - I'll accept the currency ID of the US dollar. In purchase order processing, I can have as many detail lines as I want. I can start entering them in the grid provided. - Let's look up one item that I commonly order. I'll select it and enter the quantity. You can see that the unit cost is automatically populated from the last time I purchased it from this vendor. - I'll also select the site ID, which in this case is the warehouse. This was easy for me because I already had a relationship set up between the item and the site, as well as between the item and the vendor. - Now, let's add a new item to this purchase order and see what happens when there is no existing relationship. I'll look up the item that I know is not associated with this vendor. It prompts me with a message saying there is no relationship between the item and the vendor. - I'll add the item, which allows me to specify a vendor item and add a vendor description if needed. I can also provide additional order information. - I'll accept the defaults and continue entering more lines. I can add as many...

Award-winning PDF software

What is Purchase Order processing explain in detail Form: What You Should Know

Gov Most companies submit tax payments electronically through the U.S. government. However, some companies will use paper payments if you prefer. If you use paper payments, you can't make changes during the first 2 weeks of tax period to reflect changes of the tax period. You must make tax payments all 8 weeks of the tax period unless you have made the required filing requirements. Forms 4684, 4690, 4691, 4871, 4872, 4873, 4878, 1040 — Employer's Annual Income Tax Return — CA.gov If your Form 940 will be completed and filed between January 1 and April 30 of the following year, you are required to file a corrected tax return by April 30. If your Form 940 is completed and filed after January 1, but before April 30, you must file a corrected return by June 30. If your Form 940 will be filed after July 1, the filing is not required until the 30th. If you are filing Form 940-EZ, don't fill out a Form 4684. The Form 4684 and the other tax return forms are filed by all employers with a tax year that begins after July 1. They are not part of the FTA reporting requirement — Required filing — CA.gov If you are an employee who is receiving regular wages, you do not need to file a separate Form 1040 or Form 740 for the year. Only the wage withholding for Social Security payroll taxes need to be reported on Form W-2. If you are an independent contractor, you will owe federal and state taxes on your net profit of 200,000 or more in a calendar year, or 20% of your net profit of 2,000,000 or more, whichever is less, if you are not able to file Form 1040 or Form 740. If you are an independent contractor, and you are making net profit that exceeds 200,000 in a calendar year, you need to file a self-employment income tax return using Form 1040 or Form 741, provided that the gross profit from your business is 200,000 or greater.

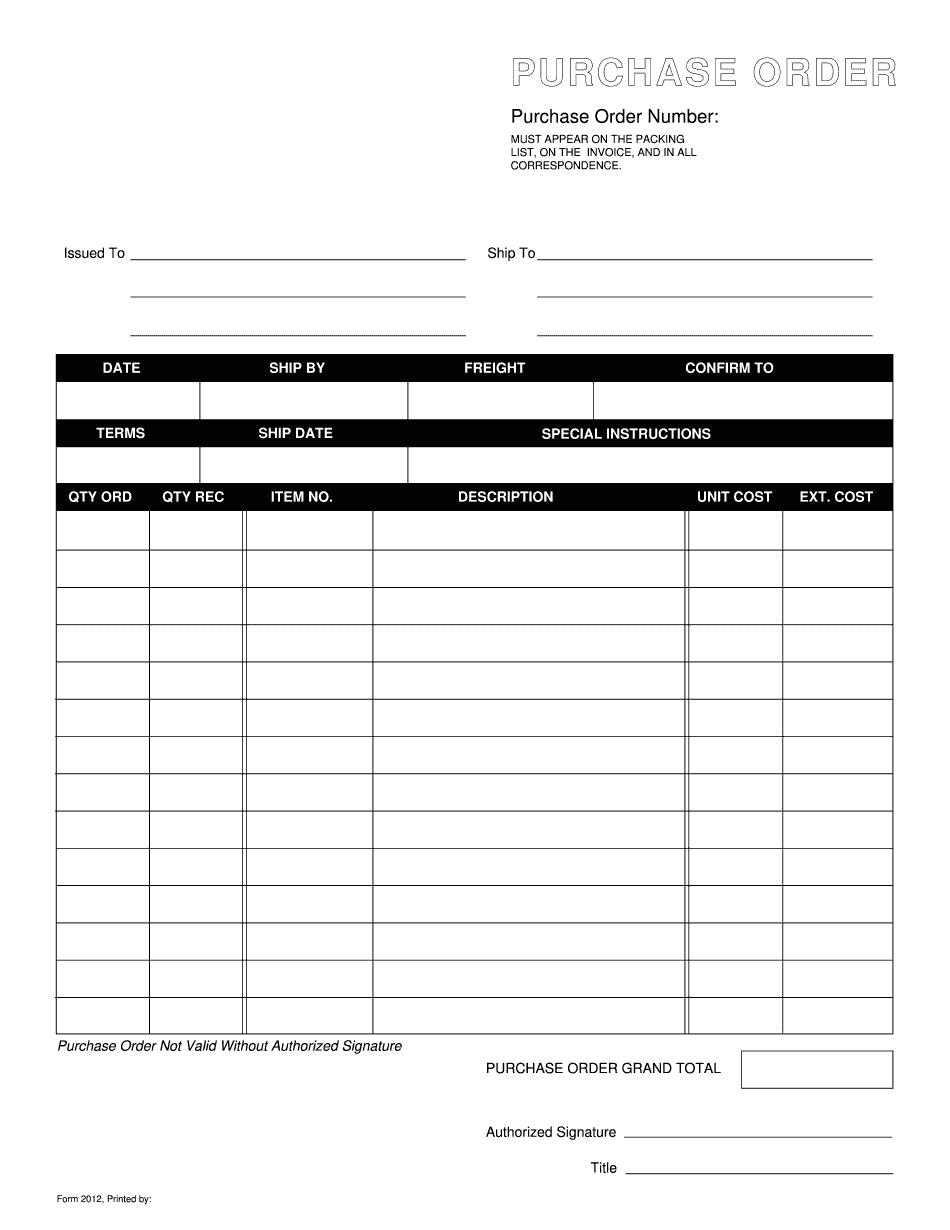

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Purchase Order, steer clear of blunders along with furnish it in a timely manner:

How to complete any Purchase Order online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Purchase Order by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Purchase Order from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing What is Purchase Order processing explain in detail